This article first appeared in The Edge Malaysia Weekly on September 30, 2024 – October 6, 2024

ONCE considered a ghost town, Forest City is set to see renewed interest because of government incentives to jump-start the special economic zone (SEZ), particularly the zero tax rate for family offices.

In early September, The Edge visited Forest City, a man-made island located just across the Johor strait, in sight of Singapore.

It was clean but desolate and though there was a lot of movement on the island, channel checks revealed most of the residents there to be workers.

The Forest City project was mooted in 2014 by China-based property development company Country Garden. With an investment plan of US$100 billion, the project was to spread over four reclaimed islands and host a population of 700,000. But only one island has been reclaimed so far and to date, Country Garden has reportedly spent RM20 billion on building some 28,000 residential units.

A resident told The Edge that while the units were fully sold, the prices had dropped significantly. “There are people staying here but most units are still vacant,” was a common remark.

On Sept 20, the government announced a slew of incentives to jump-start the Forest City Special Financial Zone (FCSFZ) as a way to resuscitate the mega development.

Company records show that Country Garden still owns 60% of the project while a private company, Esplanade Danga 88 — which is 64%-owned by His Majesty Sultan Ibrahim, King of Malaysia — holds the remaining 40%. This puts the king’s overall stake at about 25%.

The incentive that appears to have caught the most attention is the 0% tax rate for single family offices (SFOs), a move that will be closely watched given that just across from Forest City, Singapore has already established itself as a hub for SFOs, reporting a significant increase from 50 SFOs in 2018 to an impressive 1,400 by the end of 2023, according to the Monetary Authority of Singapore.

Indeed, no other country in the region comes close to the island state when it comes to the establishment of family offices.

Malaysia will have to play catch-up, given that a large segment of the population is not even familiar with the term or concept. Indeed, there is very little data on family offices in the country.

EY Asean tax leader and partner Amarjeet Singh describes family offices as privately held entities that are established to undertake investment and wealth management for high-net-worth families.

“In Malaysia, there is currently no separate tax regime for family offices. Instead, they would be subject to the general tax regime and taxed accordingly, based on the nature of their activities and income.

“For example, the interest income and investment trading gains of a family office may be taxed at 24% while property sales would be subject to Real Property Gains Tax.

“The lack of a preferential tax regime for family offices has resulted in limited public interest in them in Malaysia, although there may have been some interest in the use of Labuan limited liability partnerships and foundations for family office structures,” he tells The Edge.

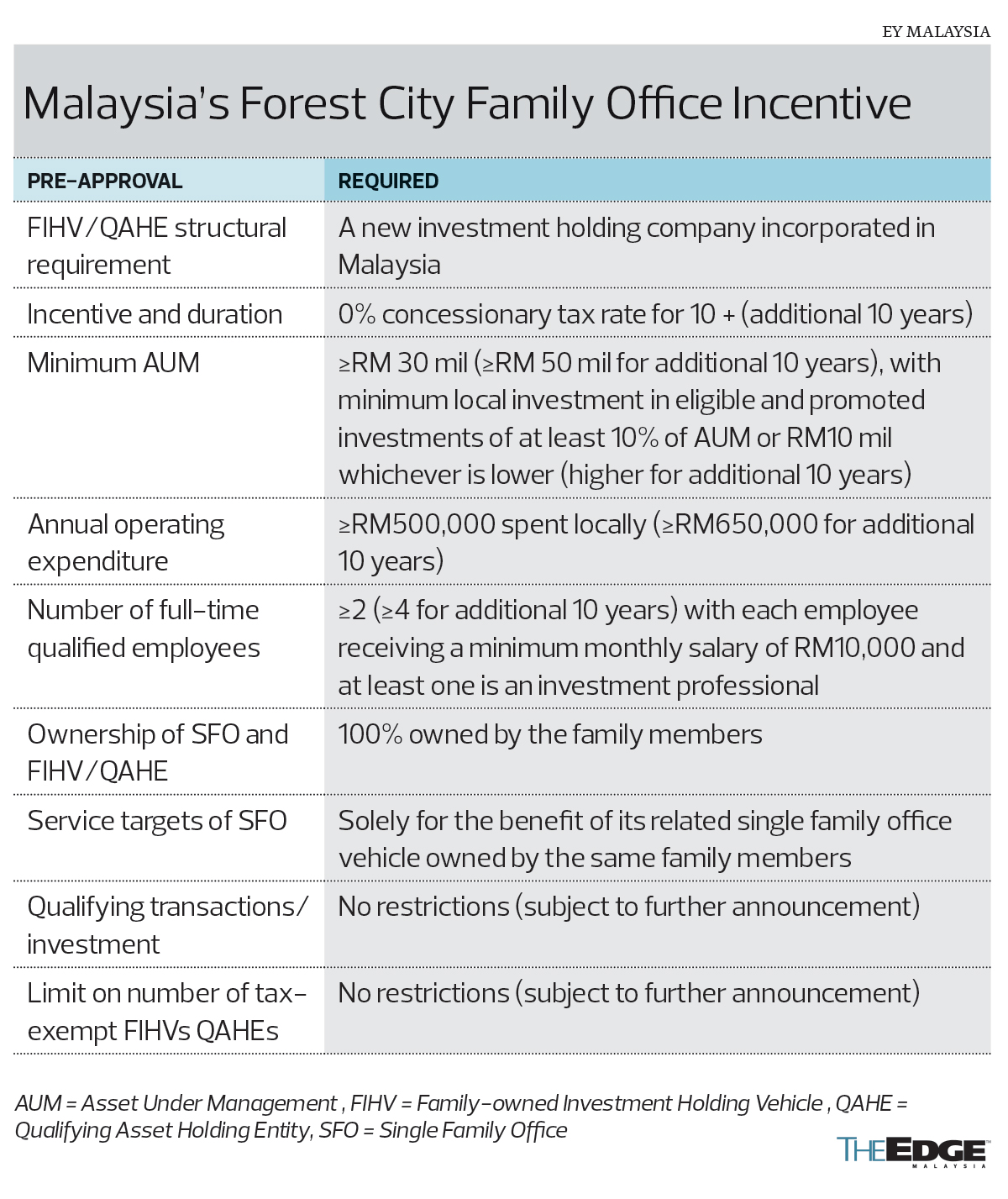

For family offices to qualify for the 0% tax rate, they would need to set up a physical office in Forest City and employ at least two locals to work there. The minimum asset under management (AUM) is RM30 million compared with Singapore’s S$20 million. This will be more attractive to high-net-worth individuals, and not just the ultra-rich.

Amarjeet explains that the concept of family offices is a relatively recent development in the region compared with the established practice in the US and Europe. It should be noted that family offices were started way back in 1838 by John Pierpont Morgan. These were further developed by the Rockefeller family in 1882, which are still in operation today.

“Singapore pioneered a dedicated tax regime for family offices in the region, complete with attractive incentives. The city state’s requirements for establishing a family office are more stringent than Malaysia’s recent proposals. The family office structure in Malaysia is currently focused on Forest City and will be coordinated by the Securities Commission (SC),” says Amaerjeet, who welcomes the move to introduce a family office set-up to attract regional and Malaysian families to manage their family wealth from Malaysia and to enhance the country’s investment landscape.

A market observer who has a family office in Singapore reckons that there would be some hiccups in the initial stages of attracting family offices to set up in Forest City as the ecosystem is not ready yet.

“Many family offices maintain significant assets and investments globally. It remains uncertain whether Malaysia will impose specific investment requirements on these entities. Such a mandate could present challenges for family offices primarily focused on overseas markets,” he observes.

While the 0% tax rate for family offices is undoubtedly attractive, Amarjeet notes that Singapore already offers tax incentives and a supportive ecosystem, making it a compelling destination for these entities.

Singapore has had a decade’s head start, having introduced the family office regime in 2014. During the pandemic, there was a pick-up in interest as wealth management sought diversification.

Amarjeet does not think that the lack of a fully developed ecosystem will be a big hindrance to Forest City’s family office aspiration given that family office structures are “not rocket science”.

“I have no doubt that Malaysian professionals who would already be familiar with family offices in other countries and in advising on investment structures generally will be in a position to serve the needs of family offices.

“The establishment of family offices in Malaysia will provide more employment and upskilling opportunities in the services and financial sectors.

“In addition to creating high-value employment opportunities and developing the services and financial sectors, family offices will also increase demand for infrastructure and property in Forest City. This aligns with the broader goal of diversifying Malaysia’s economic landscape beyond traditional hubs such as Kuala Lumpur and Penang,” he asserts.

He hopes that the family office offering will be expanded to other locations in Malaysia in due course to allow the whole country to capitalise on it.

Retaining wealth and attracting fund flow

According to Knight Frank’s 18th edition Wealth Report, Malaysia was third among selected Asian countries in the significant growth of ultra-high-net-worth individuals — those with a net worth of US$30 million (RM140.43 million) or more — over the period of 2023 to 2028. India and China led in the region.

Malaysia had 754 ultra-high-net-worth individuals at the end of 2023 and the report estimated that it will see almost 35% growth in the population of ultra-high-net-worth individuals to 1,015 by 2028.

Globally, Knight Frank expects the number of wealthy individuals to rise by 28.1% during the five years, with Asia leading the growth. Because of the growth projections, it is timely for Malaysia to tap the trend.

Experts believe that family offices play an increasingly important role in the financial system, at the same time boosting the economy by providing capital and financing for companies and institutions.

“Forest City, being the first and only place in Malaysia where family office businesses are required to set up physically, stands to benefit from this positive development. As a strategic gateway from Singapore to Malaysia, Forest City is poised to benefit from a net inflow with clear requirements for office space as well as a yearly expenditure requirement and talent to reside there.

“By offering a competitive and comprehensive package, coupled with a clear and streamlined tax incentive application process, FCSFZ primarily aims to attract foreign investors or wealth to invest in Malaysia, leveraging talent both in Malaysia and globally,” says Malaysian Venture Capital and Private Equity Association (MVCA) chairman and Artem Ventures managing partner Ng Sai Kit, who expects the venture capital private equity sector in the country to benefit from the move.

“Moving forward, this scheme will create opportunities for private equity and venture capital fund managers to partner with family offices in co-investment opportunities,” Ng says.

EY Singapore tax partner, Asean private tax leader Desmond Teo explains how family offices play a role in boosting the local economy in Singapore.

“A family office can serve as an anchor for domestic wealth, particularly in today’s interconnected global market. By establishing a family office in Singapore, family wealth becomes more closely tied to the country’s economy.

“In addition, a favourable ecosystem is crucial to attract foreign family offices. Singapore and Dubai have demonstrated success in this regard, and Malaysia aspires to follow suit,” he tells The Edge.

Attracting family offices to the country also offers them the advantage of diversification of investments in Malaysian assets, such as property, capital markets, private equity and start-ups. This can provide much-needed capital to fuel the growth of these sectors.

Moreover, he says, “family offices create jobs directly, requiring services from bankers, lawyers, advisers and accountants, among others.

“This multiplier effect contributes significantly to the local economy, going beyond the two-employee requirement often associated with family offices.”

Teo says family offices also go beyond investments as they also engage in philanthropic activities, healthcare initiatives and educational programmes, fostering a vibrant ecosystem.

“It’s about quality not quantity. Singapore’s focus on high-quality family offices willing to invest in people and talent is a model Malaysia should emulate. As Malaysia moves in this direction, we anticipate increased demand for skilled professionals,” he adds.

At Invest Malaysia 2024 last week, which was held in Forest City, Prime Minister Datuk Seri Anwar Ibrahim said the announced incentives are expected to attract international capital to FCSFZ and Johor, which he said is poised to become one of the country’s main growth engines.

Boosting local liquidity, job creation

TRATAX Sdn Bhd executive director Thenesh Kannaa considers the move as timely to tap the growing number of centimillionaires — a term used to describe individuals with a net worth of more than US$100 million.

Thenesh says over the past decade, the number of centimillionaires has grown 54% to 29,350, with China posting the highest growth rate of 108%. He adds that family offices are a popular wealth management and wealth succession planning tool among this group.

“High-net-worth individuals need a politically neutral and economically stable jurisdiction to facilitate their diversified global investment strategy.

“If we succeed in attracting high-quality family offices, it will only make Malaysia’s investment and economic climate more vibrant,” he points out.

The SC has said it is working with the relevant stakeholders to operationalise the scheme by the first quarter of 2025. SC chairman Datuk Mohammad Faiz Azmi said the economic multiplier effect of the initiative is estimated at RM3.9 billion to RM10.7 billion.